Business acumen is a critical leadership skill, allowing you to make informed decisions that give you a competitive advantage.

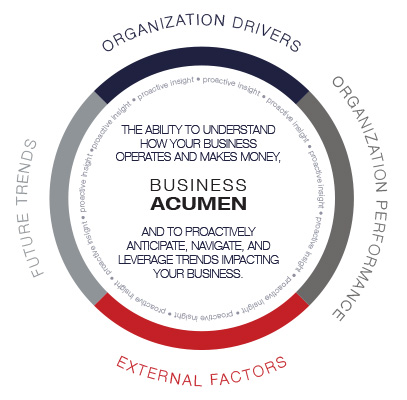

Organizations thrive when their leaders grasp the financial impact of every decision. Business acumen is the understanding of how the business operates, makes money, and grows profitably. It is a skill that everyone in your organization needs to develop. Business acumen is everyone’s business, not just the accounting or finance department’s responsibility. It is important that you understand how your role and your department fits into the big picture and how it contributes to the success and profitability of the organization.

Business Acumen Helps Generate Business Insights

Every business and organization’s ability to grow profitably is affected by the four key elements of business acumen: (1) organizational drivers, (2) organizational performance, (3) external factors, and (4) future trends.

Every business and organization’s ability to grow profitably is affected by the four key elements of business acumen: (1) organizational drivers, (2) organizational performance, (3) external factors, and (4) future trends.

Organizational Drivers

Understanding the drivers that affect your organization, and how each position influences those drivers, helps focus your thinking on the key drivers as well as on current and future trends that may affect your organization’s ability to create value, grow, and remain competitive. Your ability to recognize, understand, and leverage these trends contributes to the long-term, strategic success of your organization.

Organizational drivers are factors that create value for your organization, and there are many. Organizational drivers vary by industry, but they will generally fall into similar clusters, including people, revenue, operational efficiency, product, and quality. A common example of an organizational driver is customer experience.

A positive customer experience has great potential to drive organizational value, and it is a driver that everyone in the organization affects on some level, whether he or she is a front-line employee or in other areas of operations. Each functional area of the organization has an impact on your customers’ experiences with your brand.

Organizational Performance

Understanding how your team affects the overall performance of the organization is too important to be left solely to the finance department. Each role and department affects the performance of the organization. As a result, individuals need to understand how they affect their department’s budget. Individual performance goals must link to the success of the organization overall, for example, how team members will drive awareness and sales to help reach organizational revenue goals.

Each department has financial indicators that they should use to track and measure the impact they are having on the organization’s performance. For example, a manufacturing plant manager will likely use indicators such as process waste level, inventory shrinkage rate, quality index, and process or machine downtime to assess how the manufacturing department is performing. A sales and marketing manager is not going to be too concerned with these measurements, but for his or her department the manager will be analyzing market share, brand equity, cost per lead, and customer complaints and satisfaction.

External Factors

Leaders need to be aware of changing external factors and how those external factors affect their organization. External factors are things that happen outside of your organization over which you have no control. Examples of external factors include regulations, politics, economic conditions, customer requirements, and competitors. External factors have the ability to threaten as well as present new opportunities to your organization. It is not enough to simply understand and be aware of these factors. Leaders also need to be innovative, proactive thinkers to mitigate potential threats and leverage new opportunities that external factors may create.

Future Trends

Future trends with the ability to affect your business include competitive, regulatory, socioeconomic, environmental, technological, and customer market trends.

It is very easy for organizations today to get blindsided by the future, and part of this issue is scalability and competition. We are seeing businesses scale up faster than ever before in history. For example, it took over 200 years for the first billion bicycles to be sold in the world, 23 years for McDonald’s to sell its first billion hamburgers, 5½ years for Uber to sell the first billion rides, and just 11 months for Uber’s competitor in China, Didi Chuxing, to sell its first billion rides—just within China!

No industry is safe. Today, it is entirely possible to lose market dominance to a competitor that did not exist months or even weeks ago. The call to action may be quick scalability to own the market. Think about how your organization can simplify and streamline its offerings for fast growth without cannibalizing its key brands.

Understand Financial Management Using Business Acumen

Generating business insights relies heavily on understanding and managing the financial performance of your organization. Managing financial performance is too important to be left alone to the chief financial officer. All leaders must have a basic understanding of financials and department budgets.

Every business is in business to make money, and it is your financial statements that tell the story of how you do that. Learning the language of finance opens new insights for you into what is working in your organization and what is not, how you are performing based on historical data and in real time and provides the financial information you need to make the right investment decisions for the future of your organization.

Key performance indicators (KPIs) are figures that help you assess the performance of your organization. Examples of commonly used KPIs include net profit margin, gross profit margin, earnings before interest, taxes, depreciation and amortization, revenue growth rate, return on investment, return on assets and equity, and debt-to-equity ratio, just to name a few. Nonprofit organizations may track performance metrics such as donor number growth, donation growth, and donor retention rate. The same applies to public sector organizations that may measure things such as percent of programs exceeding their evaluation goals or the ratio of operating costs to budget. Often represented as a ratio, KPIs help tell the story of how your organization is performing financially, as well as how you might adapt or adjust to trends.

Use Business Acumen to Improve Productivity & Process Efficiency

Productivity and efficiency are terms that sometimes are incorrectly used interchangeably. Productivity is determined by the amount of output produced during a set period of time, whereas efficiency is more concerned with the quality of the output. Some companies measure output based on productivity efficiency or efficient productivity, which takes both of these concepts into account. This results in a net output, which subtracts faulty and rejected product from the total amount of output (productivity) during a period of time.

Productivity and efficiency are terms that sometimes are incorrectly used interchangeably. Productivity is determined by the amount of output produced during a set period of time, whereas efficiency is more concerned with the quality of the output. Some companies measure output based on productivity efficiency or efficient productivity, which takes both of these concepts into account. This results in a net output, which subtracts faulty and rejected product from the total amount of output (productivity) during a period of time.

Processes are meant to help improve productivity efficiency by defining steps to ensure that tasks are done correctly and consistently. It has been argued that process is actually the antithesis of productivity. In truth, a process can be productivity’s best friend or worst enemy, depending on the efficiency of process requirements.

If a process has too much red tape—approval checks and balances—that red tape gets in the way of accomplishing even the simplest tasks in a reasonable amount of time, your process is inefficient and is working against the productivity of your organization. However, processes that are working well have a great ability to streamline tasks to improve efficiency and productivity.

Productivity and process efficiency are important aspects of understanding the big picture of how the organization creates value. Let’s say that you become aware that one of your competitors can sell its product at a price that is 25 percent less than your best price. The likely reason is because your competitor can produce, ship, or distribute the product at a more efficient rate; therefore, it has a lower overhead and can pass those savings along to customers to create value and strategic advantage. This leads you to realize that you need to focus your efforts on improving process efficiency and productivity in your own organization to remain competitive and relevant.

Understanding the business requires the study of how internal and external factors interact to develop the big picture view of how the organization exists within the larger business environment. To understand the many facets of what creates business value to drive strategic advantage, managers must be able to generate business insights, practice financial management, influence productivity, and process efficiency improvements.

Core Competency: Understands the Business

Develops business acumen to understand how businesses and organizations work. Applies knowledge of business drivers, financial indicators, and technology to generate productivity and insights.

Business Acumen Competency Skills

- Generates Business Insights: Uses knowledge of business drivers, trends, and how organizations make money to guide actions and generate insights

- Financial Management: Uses financial indicators and analysis to evaluate options and proactively manage financial results

- Productivity and Process Efficiency: Recognizes synergies and processes in need of improvement and makes suggestions to address problems

The Leader’s Business Acumen Toolkit

Put business acumen development to action by selecting members of your team to research current trends that affect your organization or department. Have these individuals present their findings to the large group and facilitate discussion around the trends in terms of their potential impact. Here is the recommended facilitation:

- Present an overview of the key trends to the large group.

- Split the group up into two groups for discussion and have each group select a facilitator and a scribe.

- Group 1 discusses: How could this trend positively affect our business? To what degree (1–10 high) could this trend affect our business positively? What action(s) do we recommend to leverage this trend?

- Group 2 discusses: How could this trend negatively affect our business? To what degree (1–10 high) could this trend affect our business negatively? What action(s) do we recommend to mitigate the possible negative impacts of this trend?

- Have each group present to one another and together determine what further actions (if any) should occur.